I never set out to become an expert in health insurance. I just wanted to take care of my family and not feel like I was lighting money on fire every month. If you’re self-employed, you know the drill. Every year it’s the same dance: compare plans, fill out forms, get hit with a number that makes you say, “There’s no way that’s right.”

For years, I paid over a grand a month for coverage that somehow didn’t cover anything. I’d get bills that made no sense, sit on hold for hours, and still end up paying for stuff I thought was included.

It’s the one part of being a dad and a business owner that always made me feel helpless. No matter how hard I worked, this one system had me beat.

One afternoon, I was sitting at the kitchen table doing that dreaded math again. Premiums, deductibles, out-of-pocket limits, and whatever else they can think up to confuse you. I just thought, this is insane.

I’d rather take that money and buy peace of mind somewhere else.

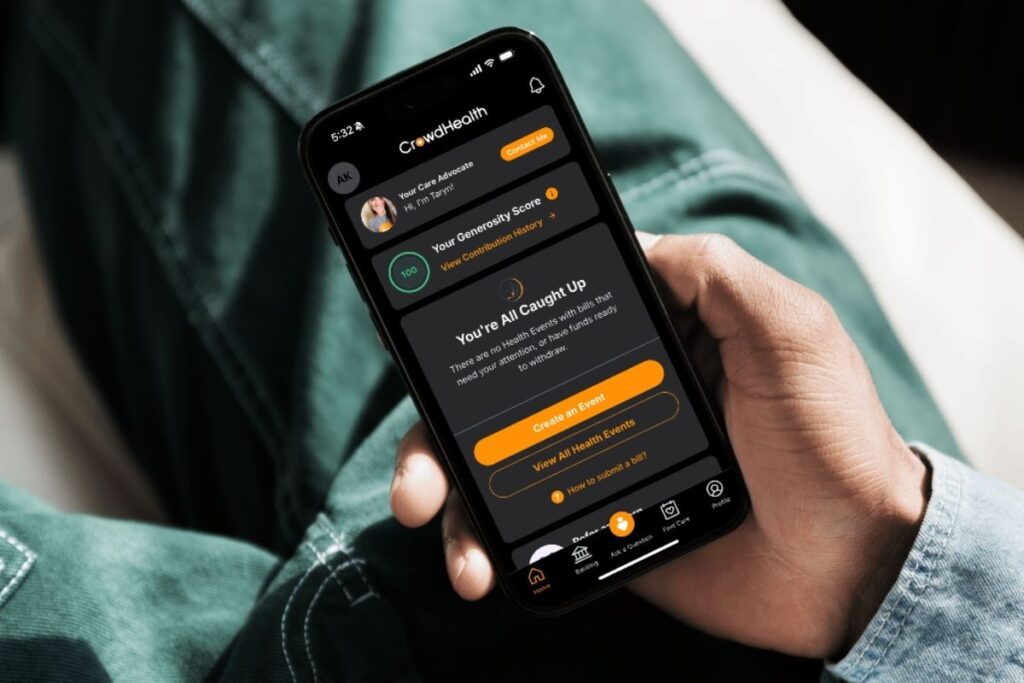

That’s when I found CrowdHealth.

At first, I figured “community health” was just another gimmick. It sounded like one of those vague startup ideas that disappears in six months. But I started reading, watched a few interviews, talked to a couple of members, and it just made sense. It was simple, transparent, and cheaper.

So I joined.

Within a month, my costs dropped by about 40 percent. My family of four went from paying $1,000 to under $600. And if something major happens, my max out-of-pocket is $500.

That’s it. No fine print. No “actually, that’s not covered.”

I still remember talking to my wife after that first month and saying, “I think this might actually work.”

The biggest game changer has been the virtual care.

With two little kids, someone is always coughing, sneezing, or breaking out in a rash. Now, instead of packing everyone in the car for urgent care, I just open the app, hop on a call, and talk to a real doctor. Usually within minutes.

They take their time, ask real questions, and if we need a prescription, it’s handled right there. It’s easily the most dad-friendly system I’ve ever used.

(And just to be clear, if it’s an emergency, you go to the ER. No question. This just covers everything else that makes parenthood a constant game of “Is this serious or just Tuesday?”)

But what really sold me wasn’t the cost or convenience. It was the community.

A few months back, I got an email from CrowdHealth about a woman who lost her husband unexpectedly. Members could chip in to support her as she faced life grieving an unimaginable loss while taking care of two little boys. My wife and I sent a little bit through Venmo.

It wasn’t much, but it felt right.

When was the last time your insurance company asked you to help someone instead of sending you another bill? That moment made it feel less like a system and more like a circle. Real people helping each other out.

I don’t usually write stuff like this, but switching to CrowdHealth has been one of the best calls I’ve made. Not just for our budget, but for my sanity. It’s simple. It’s human. And it doesn’t make me feel like I’m getting hustled every month.

I used to think traditional insurance was the responsible thing to do. Now I think being responsible means finding something that actually works.

So yeah, I’m not going back.

“Peace of mind shouldn’t cost more than your mortgage.”

Being a dad means protecting your family. Sometimes that means finding a smarter way to do it, even if it means walking away from the system everyone else says you need.

Editor’s Note:

Yep, we use CrowdHealth ourselves here at Dad Day. It’s been a game-changer for our own families, which is why we’re comfortable sharing this story.

If you want to give it a try, you can use our code DADDAY for a 3 month discount on your membership.